Making Tax Digital for Income Tax starts on 6 April 2026.

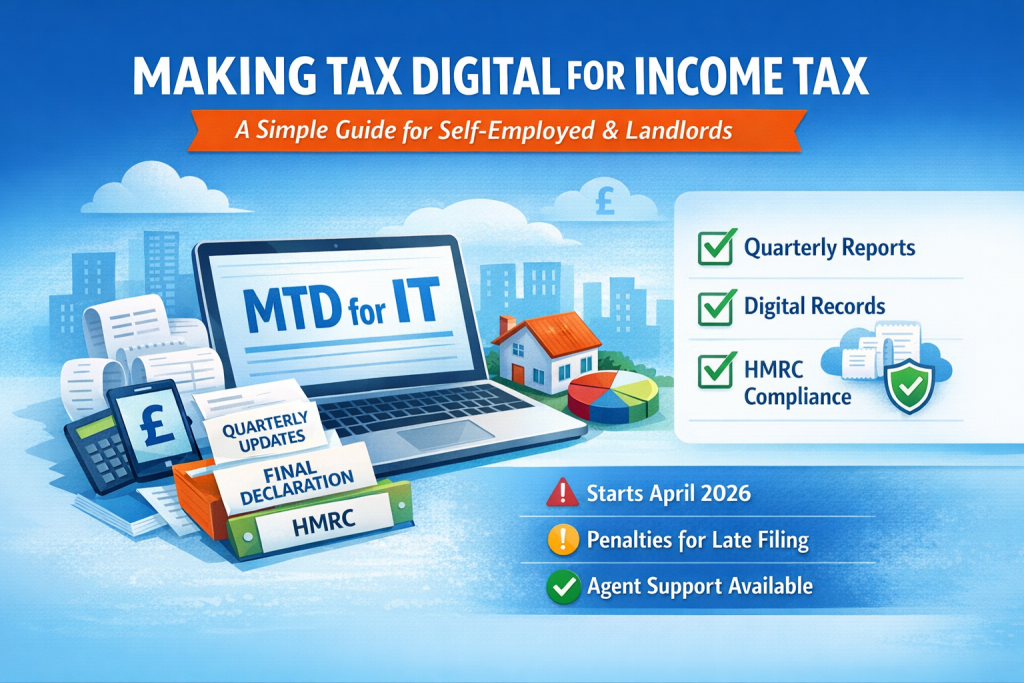

Making Tax Digital for Income Tax (MTD for ITSA) is one of the biggest changes to UK tax reporting in decades.

From 6 April 2026, many self-employed individuals and landlords must submit quarterly digital updates instead of one yearly tax return.

This guide explains everything in simple English, including who must join, deadlines, penalties, software requirements, and how to prepare step by step.

Why HMRC Is Introducing Making Tax Digital for Income Tax

HMRC estimates that billions of pounds are lost every year due to mistakes in tax returns.

Many people also struggle to keep records, which leads to incorrect tax bills and penalties.

MTD aims to:

- Reduce tax errors

- Encourage digital record keeping

- Provide real-time business information

- Help taxpayers understand their finances better

When Does Making Tax Digital for Income Tax Start?

MTD for Income Tax will start in stages depending on your turnover.

| Tax Year Reviewed | Turnover Threshold | MTD Start Date |

|---|---|---|

| 2024–25 | Over £50,000 | 6 April 2026 |

| 2025–26 | Over £30,000 | 6 April 2027 |

| 2026–27 | Over £20,000 | 6 April 2028 |

The government may expand MTD to lower incomes in the future.

Who Must Join Making Tax Digital for Income Tax?

You must join MTD if you are:

- Self-employed (sole trader)

- A landlord with UK property income

- A person with combined turnover above the threshold

Turnover includes:

- Business income

- Rental income

- Combined total of all sources

Who Does NOT Need to Join?

You do not need to join if:

- Your turnover is below the threshold

- You only operate through a limited company

- You are digitally exempt (for example due to disability, age, or religious reasons)

Limited companies will have MTD Corporation Tax in the future, but it is not active yet.

MTD for Income Tax: Turnover vs Profit Explained

Many people confuse turnover with profit. However, they are very different.

Turnover - Total money you receive before expenses

Profit - Money left after expenses

Example:

- Income: £60,000

- Expenses: £40,000

- Profit: £20,000

You must join MTD because turnover is £60,000, even though profit is low.

HMRC Quarterly Updates Under Making Tax Digital

Under MTD, you must submit four quarterly updates every tax year.

These updates show:

- Total income

- Total expenses

- Summary of business activity

They are not final tax calculations.

Quarterly Update Deadlines

| Period | Submission Deadline |

|---|---|

| 6 Apr – 5 Jul | 7 Aug |

| 6 Jul – 5 Oct | 7 Nov |

| 6 Oct – 5 Jan | 7 Feb |

| 6 Jan – 5 Apr | 7 May |

Final Declaration Under Making Tax Digital for Income Tax

After the tax year ends, you must submit a final declaration.

This replaces the Self Assessment tax return.

The final declaration includes:

- Allowances

- Adjustments

- Capital allowances

- Reliefs

- Final profit figures

Tax payment deadlines stay the same, usually 31 January after the tax year.

Digital Record Keeping for MTD for Income Tax

You must keep digital records of:

- Income

- Expenses

- Transaction dates

- Expense categories

- Business details

What Counts as Digital Records?

You can store records in:

- Accounting software

- Spreadsheets (Excel, Google Sheets)

- Digital bank statements

- Apps connected to your bank

Paper records alone will no longer be enough.

Accounting Software for Making Tax Digital for Income Tax

Option 1: Bridging Software (Low Cost) - You keep records in a spreadsheet and use bridging software to submit to HMRC.

This option is:

- Cheaper

- Good for simple businesses

- Suitable for landlords with few properties

Option 2: Full Accounting Software (Recommended)

Software such as listed below can automatically track income and expenses.

- Xero

- QuickBooks

- Sage

- FreeAgent

Benefits include:

- Automatic bank feeds

- Real-time profit reports

- Easy quarterly submissions

Penalties Under Making Tax Digital for Income Tax

HMRC uses a penalty points system.

Submission Penalties

- 1 missed quarterly update = 1 penalty point

- 4 points = £200 fine

- Additional missed updates = £200 each

Late Payment Penalties

If you pay tax late, HMRC charges:

- Interest on unpaid tax

- Additional late payment penalties

What If Your Income Falls Below the Threshold?

If your turnover falls after joining MTD, you usually stay in the system for three years.

Therefore, you must continue submitting quarterly updates.

What If You Stop Trading or Renting Property?

If you stop business or rental activity:

- Submit final quarterly updates

- Inform HMRC

- HMRC removes you from MTD once confirmed

Real-Life Examples

Example 1: Self-Employed Consultant

Sam earns £55,000 in 2024–25.

He must join MTD from April 2026 and submit quarterly updates.

Example 2: Landlord with Falling Income

Rita earns £35,000 rental income and joins MTD in 2027.

Her income later drops to £15,000, but she stays in MTD for three years.

Example 3: Business Closure

Mike stops trading in November.

He submits final updates and informs HMRC.

After confirmation, he exits MTD.

Benefits of Making Tax Digital for Income Tax

Although MTD means more reporting, it also has benefits.

- Better Financial Control - Quarterly updates help you understand your income and expenses regularly.

- Fewer Tax Errors - Digital records reduce manual mistakes and missing information.

- Real-Time Business Insights - You can see profits, expenses, and cash flow during the year.

- Less Paperwork - Digital storage means fewer paper receipts and files.

Challenges of MTD for Self-Employed and Landlords

- More Frequent Reporting - Instead of one tax return, you submit five reports per year (4 updates + final declaration).

- Strict Deadlines - Missing deadlines can lead to penalties and stress.

- Learning Digital Tools - Some people are not comfortable with software and online systems.

Many taxpayers choose an accountant to manage MTD compliance.

How to Prepare for Making Tax Digital (Step-by-Step)

Step 1: Check Your Turnover

Calculate your total turnover from:

- Self-employment

- UK property income

Step 2: Start Digital Record Keeping

Use spreadsheets or accounting software.

Scan receipts and store them digitally.

Step 3: Choose MTD-Compatible Software

Decide between bridging software or full accounting software.

Step 4: Register for MTD

You must sign up with HMRC before your start date.

Step 5: Work with an Accountant (Optional but Recommended)

An accountant can:

- Set up software

- Submit updates

- Handle HMRC communication

- Reduce penalties and errors

Making Tax Digital for Income Tax Frequently Asked Questions (FAQs)

Do I Pay Tax Quarterly Under MTD?

No. You still pay tax once a year. Quarterly updates are only reports.

Is MTD Mandatory for All Self-Employed People?

No. Only those above the turnover threshold must join.

Do Landlords Need to Join MTD?

Yes, if combined rental and self-employed turnover exceeds the threshold.

Can My Accountant Submit Updates for Me?

Yes. Your accountant can submit updates with digital authorisation.

Can I Use Excel for MTD?

Yes, but you need bridging software to send data to HMRC.

What Happens If I Miss a Quarterly Update?

You receive penalty points. After four points, you pay £200.

Is MTD Delayed Again?

The government has delayed MTD before, but current dates are confirmed.

Summary: Key Points to Remember

- MTD for Income Tax starts from 6 April 2026

- Quarterly digital updates are mandatory

- Final declaration replaces Self Assessment

- Turnover determines whether you must join

- Penalties apply for late submissions

- Digital records and software are required

Next Steps

If you are self-employed or a landlord, start preparing early.

Digital record keeping and software setup will save you stress and penalties later.

Consider speaking with an accountant to ensure full compliance with Making Tax Digital for Income Tax.

How Taxes4U Can Help

Taxes4U provides full support for Making Tax Digital for Income Tax:

- MTD registration

- Quarterly submissions

- Final declarations

- HMRC communication

- Bookkeeping and tax advice

Contact Taxes4U today for a free MTD eligibility check and avoid penalties.

Other blog posts that you might be interested in

- The Early Bird’s Guide to Maximising Your UK Tax Return for 2024/2025

- Timelines, guidelines and recommendations for the UK Tax Return submission

- Late Tax Return Penalties and Appeals – What is it and how to deal with it?

- How to Register as Self-Employed in the UK: A Step-by-Step Guide

- Ultimate Guide to Self-Employed Mortgages in the UK: Navigating Tax Returns, SA302, and More

- CIS Registration UK: Everything You Need to Know About

- UTR Registration and Cancellation: What You Need to Know